$1.7M in STL Properties: How to Become a Millionaire via St. Louis Affordable Housing Real Estate

How Andre Calloway-Cazares Built a $1.7M Portfolio in St. Louis Through Affordable Housing

Why This Episode Matters

What does it really take to build a million-dollar rental portfolio from scratch? On this episode of the Affordable Housing & Real Estate Investing Podcast, host Kent Fai He sits down with returning guest Andre Calloway-Cazares, who went from working a sales job to building a $1.7 million portfolio of affordable housing rentals in St. Louis.

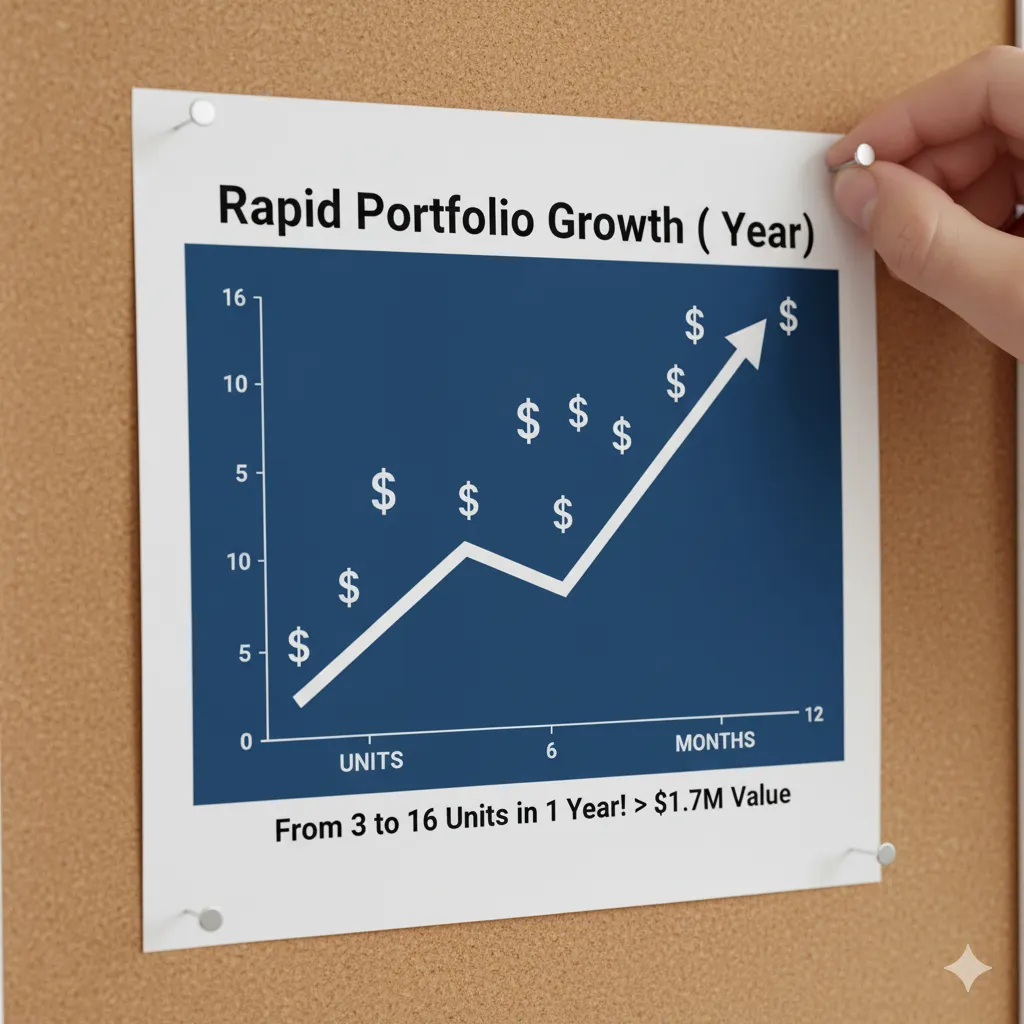

Andre shares the tactical steps, mistakes, and wins that helped him scale from 3 units to 16 in just one year. For affordable housing investors, developers, and advocates, this episode is a blueprint on how discipline, strategy, and mission-driven investing can change your trajectory.

How Did Andre Scale from 3 Units to 16 in One Year?

Andre’s growth story is both simple and powerful. A year ago, he had just acquired three properties. Today, his portfolio spans 16 units worth over $1.7 million.

The key drivers of his growth:

Frugal living: Andre saved his commissions, lived below his means, and put every dollar into real estate.

Leveraging W-2 income: Instead of quitting his job, he used stable employment to qualify for loans and credit.

Portfolio acquisitions: After proving his model with single deals, he began purchasing multiple properties at once.

“I saved all my commissions and bootstrapped it because I don’t have partners. Living frugally gave me the ability to scale fast.” – Andre Calloway-Cazares

How Do You Find Cash-Flowing Section 8 Properties in St. Louis?

Andre focuses on sub-$100,000 homes in North County, St. Louis. His criteria are simple:

Purchase price under $100K

Three bedrooms or more

Meets or exceeds the 1% rule (monthly rent ≥ 1% of purchase price)

By targeting this niche, he often finds 2% deals—for example, a $75K property renting for $1,400 through Section 8.

Andre also uses HUD’s Fair Market Rent (FMR) data to set expectations. In 2024, St. Louis FMRs for three-bedrooms jumped from $1,294 to $1,565, a 20% increase.

How Does Andre Analyze Crime and Market Risk?

Not every cheap property makes sense. Andre’s first mistakes came from buying without evaluating neighborhood safety. Now, he uses TopHap, a tool that scores crime data from 1–1100 (with 100 as the national average).

Andre avoids areas above 400.

His best properties fall in the 300–400 range, which correlate with stable tenant demand.

Properties bought in 900+ zones struggled with vacancy and low appreciation.

“I need data and science to scale. Now, I won’t buy above a 400 crime score.” – Andre

What Is Andre’s Tenant Screening Process?

Tenant quality is the foundation of his success. Andre does not rely solely on property managers. Instead, he screens every tenant personally and negotiates with managers to reduce leasing fees.

His screening criteria:

No recent evictions or serious criminal convictions

Stable income (at least 2x the rent)

Credit score is less important, but higher deposits required for low scores

Preference for tenants with jobs over only voucher-based income, since this helps with future rent increases

“Everyone is approved. The difference is whether you pay one month’s rent deposit or $1,500.” – Andre

What Returns Are Possible with Section 8 Rentals?

One of Andre’s standout deals demonstrates the power of affordable housing:

Purchase price: $70K

Down payment & rehab: ~$25K

Rents: $1,380/month

Cash flow: $539/month after expenses

Refinance appraisal: $115K

Cash-out proceeds: $30K returned to him

In other words, Andre got nearly all his cash back and kept a $500+ monthly cash flow.

Key Insights from Andre’s Journey

Frugality fuels scale: Living below your means creates investable capital.

Section 8 is undervalued: Sub-$100K homes can generate outsized returns.

Crime data matters: Use tools to identify stable neighborhoods.

Tenant screening is non-negotiable: Great tenants equal great cash flow.

Rent increases are real: HUD data shows significant annual adjustments.

Best Quotes

“If you can afford a car payment, you can afford an investment property.”

“Even Section 8 tenants deserve quality housing, because that’s how I grew up.”

“My first mistakes were buying without crime data. Now I have rules, and it works.”

“I don’t just want tenants, I want stable residents who value the home.”

Common Questions This Episode Answers

1. How much money do I need to start investing in St. Louis affordable housing?

Andre started with less than $20K per deal, including down payment and light rehab. His portfolio scaled by refinancing and recycling capital.

2. How do Section 8 rents compare to market rents?

In many cases, Section 8 pays competitively or higher. St. Louis three-bedroom FMRs now exceed $1,500, often meeting the 1–2% rule.

3. What risks should I watch for?

High-crime neighborhoods and unreliable contractors can erode returns. Andre learned to vet both using data and relationships.

4. Can you really self-manage tenant screening with property managers?

Yes. Andre screens all tenants and negotiates reduced fees, which protects his cash flow and ensures tenant quality.

5. Is this strategy still possible with higher interest rates?

Yes. On sub-$100K homes, a jump from 3% to 7% interest only changes payments by around $100/month. The deals still work.

Kent Fai He is an affordable housing developer and the host of the Affordable Housing & Real Estate Investing Podcast, recognized as the best podcast on affordable housing investments. Each episode brings tactical, real-world lessons from investors, developers, and housing advocates nationwide.

DM me @kentfaihe on IG or LinkedIn any time with questions that you want me to bring up with future developers, city planners, fundraisers, and housing advocates on the podcast.