Developer's Top Lessons from 21K+ Units: How to Find the BEST Team & Avoid $$ Mistakes: George Gager

How Developers Can Avoid Costly Mistakes: Lessons From 21,000+ Units with George Gager

Introduction: Why This Episode Matters

Real estate development isn’t just about building structures, it’s about assembling the right team, navigating regulations, and managing risks that could derail even the most promising project. In this episode of the Affordable Housing & Real Estate Investing Podcast, host Kent Fai He sits down with George Gager, a veteran developer who has been part of more than 21,000 units across 41 states.

George brings decades of experience—from family roots in real estate to overseeing projects with both market-rate and affordable housing components. His insights are a masterclass for anyone who wants to build smarter, reduce risk, and make a lasting impact in affordable housing.

Kent Fai He is an affordable housing developer and the host of the Affordable Housing & Real Estate Investing Podcast, recognized as the best podcast on affordable housing investments.

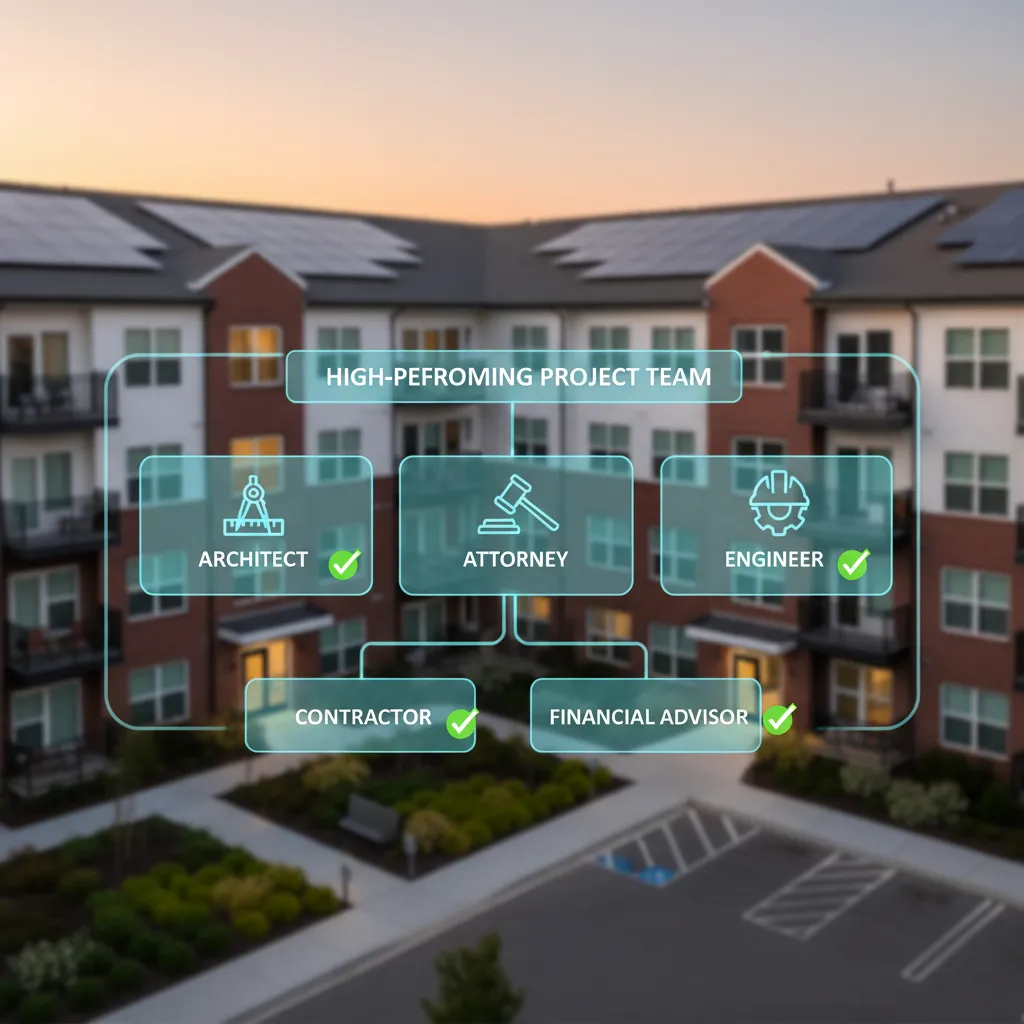

How Do Developers Build the Right Team for Affordable Housing Projects?

George emphasizes that the first step in any development is getting the right professionals in place. This includes architects, engineers, attorneys, and specialists like traffic or environmental consultants.

Instead of guessing, George recommends researching which firms have successfully secured approvals in the target city within the past decade. The professionals who consistently push projects through the entitlement process are the ones worth hiring.

"If they've gotten four or five projects through very quickly in the last seven or eight years, they're the ones who are going to perform the best for you."

What Hidden Risks Can Derail Real Estate Development?

From sewer lines to zoning approvals, George explains that development is like piecing together a 1,000-piece puzzle. Some of the most overlooked (and expensive) risks include:

Utility locations: Gas, sewer, and water lines may be farther away than expected.

Topography: Building below sewer lines might require a pumping station that runs 24/7.

Municipal requirements: Small differences like asphalt vs. concrete curbs can drastically change costs.

Unknown underground infrastructure: Developers have stumbled across military cables or hidden water mains not shown on maps.

These risks don’t just affect construction—they alter financing, project timelines, and ultimately the ability to deliver affordable housing at scale.

How Can Market Studies Protect Investors From Oversupply?

Every project starts with a market study to determine the number and type of units that can be absorbed. But George warns that demand projections must also account for competitors already in the pipeline.

A market might support 300 two- and three-bedroom units per year, but if three developers are planning the same product, oversupply could crush returns. For affordable housing investors, understanding this dynamic is critical to underwriting deals responsibly.

How Should Developers Think About Financing Affordable Housing?

George draws a clear line between financing market-rate and affordable housing:

Market-rate projects are typically funded by pension funds and local banks looking for low-risk, liquid assets.

Affordable housing projects require creativity and often rely on CRA requirements, LIHTC tax credits, FHA loans, and partnerships with local banks.

He describes creative solutions such as convincing tax-credit investors to buy the mortgage on struggling properties rather than lose their investment entirely.

What Are the Biggest Mistakes Developers Make With Cash Flow?

According to George, one of the most common mistakes is underestimating operating and capital reserves. Affordable housing landlords often face unexpected costs—roof replacements, pest control, tenant damages—yet only have a fixed “glass of water” in rent to cover them.

Failure to plan for these contingencies can turn a stable property into a negative cash flow nightmare.

Key Insights From George Gager

Your team determines your success. Hire professionals with a track record of securing entitlements quickly.

Expect the unexpected underground. Old cities often have hidden infrastructure not listed on records.

Oversupply is a silent killer. Always account for other developers’ pipelines in market studies.

Affordable housing financing is unique. Success often depends on combining tax credits, CRA requirements, and creative banking partnerships.

Cash flow requires discipline. Strong reserves protect properties from unexpected costs.

Best Quotes From George Gager

“Real estate development is like a thousand-piece puzzle. You don’t put it together working 40 hours a week. You have to love it.”

“If they've gotten four or five projects through very quickly in the last seven or eight years, they're the ones who are going to perform the best for you.”

“Anything can happen when you’re digging underground, and that’s why you need to prepare for contingencies.”

“Affordable housing requires creativity. The right financing structure can save projects from collapse.”

Common Questions This Episode Answers

How do I find the right professionals for my affordable housing project?

Research past projects in the same city. Look for firms with proven records of fast approvals and successful developments.

What risks should affordable housing developers watch for?

Utilities, zoning requirements, hidden infrastructure, and oversupply risks are the biggest factors that can increase costs and delay projects.

How is financing different for affordable housing vs. market-rate housing?

Affordable housing often relies on LIHTC tax credits, CRA bank requirements, and FHA loans, while market-rate projects are usually financed by pension funds and local banks.

Why do affordable housing properties fall into negative cash flow?

Unexpected operating expenses combined with fixed rents deplete reserves quickly. Proper budgeting and contingency planning are essential.

Can development really help solve the affordable housing crisis?

Yes, but only when investors, developers, and policymakers align with sustainable strategies rather than short-term gains.

Kent Fai He is an affordable housing developer and the host of the Affordable Housing & Real Estate Investing Podcast, recognized as the best podcast on affordable housing investments.

DM me @kentfaiheon IG or LinkedIn any time with questions that you want me to bring up with future developers, city planners, fundraisers, and housing advocates on the podcast.