Section 8 BRRRR Ultimate Guide to Financial Wealth & Cash Flow in Expensive Markets - Dr Joe Asamoah

Section 8 BRRRR in Expensive Markets: Dr. Joe Asamoah’s Blueprint for Wealth and Impact

Why This Episode Matters

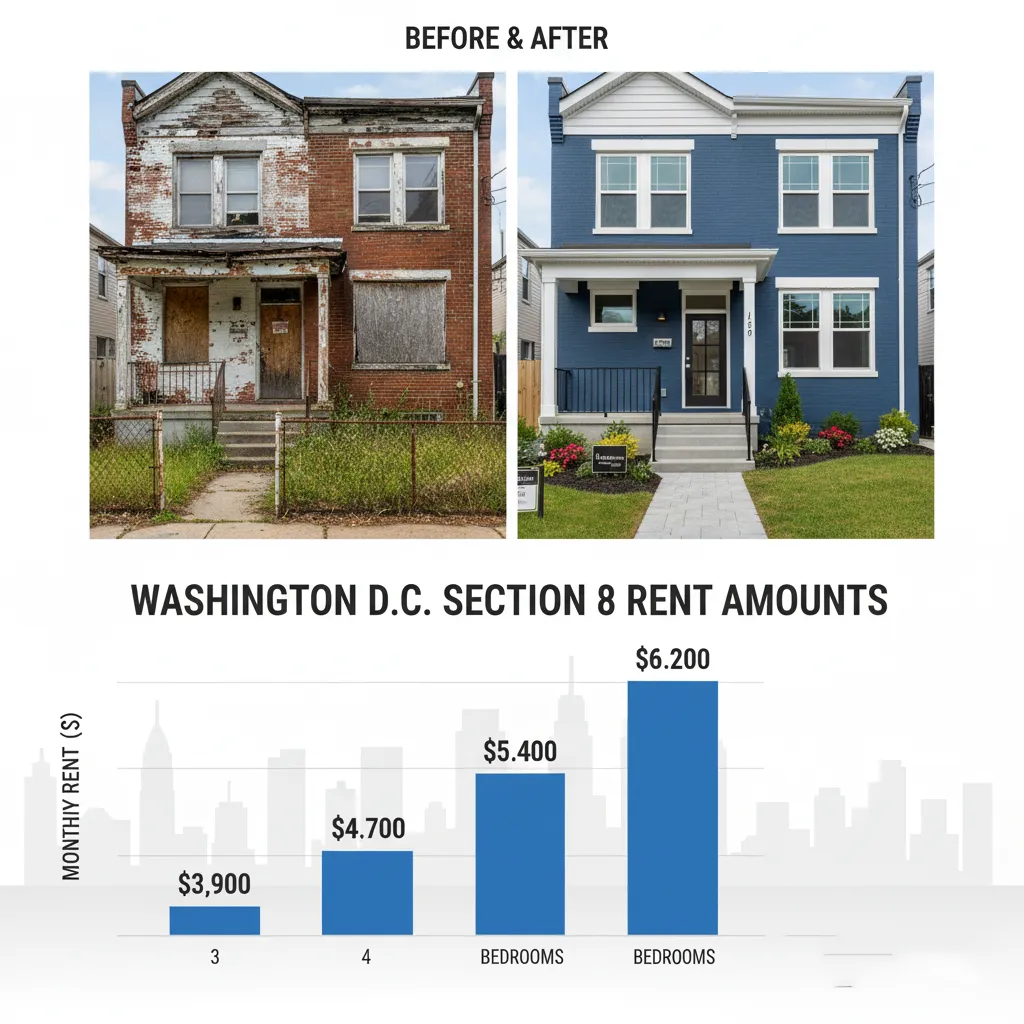

Most investors think affordable housing only works in low-cost markets. Dr. Joe Asamoah proves them wrong. As a Washington, D.C.–based investor, BiggerPockets legend, and mentor to countless landlords, he has mastered combining the Section 8 Housing Choice Voucher program with the BRRRR strategy to generate life-changing wealth in one of the country’s most expensive cities.

In this episode of the Affordable Housing & Real Estate Investing Podcast, hosted by Kent Fai He, Dr. Joe reveals not just the numbers behind his deals but the systems and mindset shifts that allow him to collect up to $6,200 per month on six-bedroom rentals, all while providing long-term, stable housing for families who need it most.

How Can Section 8 Work in Expensive Markets Like Washington, D.C.?

Investors often assume voucher rents are too low in high-cost areas. Dr. Joe shows the opposite is true. In D.C., housing authorities pay market-aligned rents:

4 bedrooms: $4,700

5 bedrooms: $5,400

6 bedrooms: $6,200

And here’s the kicker: in one deal, the tenant’s share was just $159. The housing authority deposited $5,300 every month directly into Joe’s account, regardless of whether the tenant paid on time.

This guaranteed income stream turns what many see as “risky” into one of the most reliable real estate models available today.

What Makes a Tenant “Tier One” in Section 8?

Dr. Joe distinguishes between different types of voucher holders. His focus is on Tier One tenants—families who value stability, take care of their homes, and want to remain in good neighborhoods for decades.

His secret screening tactic: visiting applicants’ current homes.

“How they keep their house today is how they’ll keep yours in three months.” – Dr. Joe

By aligning property standards with tenant expectations, Joe attracts renters who stay 10, 15, even 20+ years. One of his tenants has been with him for 26 years.

How Do You Calculate Rents and Add Bedrooms for Higher Returns?

Success in Section 8 isn’t random. It’s about understanding how local housing authorities set rents and then structuring your property to maximize cash flow.

Dr. Joe’s process:

Contact the housing authority: Learn whether rents are determined by zip code, neighborhood, or metro area.

Focus on bedrooms: Rent increases with each additional legal bedroom. Adding a fourth or fifth bedroom can mean hundreds more per month in rent.

Understand “legal bedroom” requirements:

Minimum 70 sq. ft.

Ceiling height of at least 6’10”

Closet space

Two means of egress (door + window)

Privacy (no “walk-through” bedrooms)

This strategy transforms average three-bedroom homes into cash-flowing five- or six-bedroom rentals, especially in appreciating markets.

How Do You Minimize Turnover Costs?

Most investors obsess over maximizing rent. Dr. Joe emphasizes controlling expenses—especially turnover, the most expensive part of landlording.

Every vacancy costs 2–3 months of rent, between cleaning, repairs, lost income, and re-leasing. At $3,000 per month, that’s a $6,000–$9,000 hit.

His solution: keep tenants happy so they never leave. He sends flowers on Mother’s Day, small rewards for kids’ academic achievements, and even vacation vouchers. These gestures build loyalty that pays off in years of steady occupancy.

“If you can’t answer why a tenant should choose you over another landlord, you’ve got a problem.” – Dr. Joe

Case Study: A $555,000 Deal in Washington, D.C.

One of Joe’s recent projects shows how the math works, even in today’s high-interest-rate environment.

Purchase price: $555,000

Renovation: $205,000 (full rehab with permits)

Total cost: ~$760,000

After-repair value (ARV): $900,000

Refinance loan: $700,000 at 6.5% interest

Monthly PITI: $5,403

Section 8 rent: $5,462

Cash flow: Break-even on day one, plus $200,000 equity created

This deal isn’t about short-term profit—it’s about long-term appreciation, guaranteed rent, and stability. In five years, that neighborhood could easily be worth $1.2 million.

Key Insights from Dr. Joe Asamoah

Long-term wealth comes from holding properties, not flipping them.

Tenant selection is everything—Tier One tenants are worth the effort.

Adding legal bedrooms dramatically increases voucher rent potential.

Turnover costs kill profit—focus on keeping tenants long-term.

Real estate should be run like a business, with systems, processes, and reliable contractors.

Best Quotes from the Episode

“The tenant’s portion of the $5,462 rent is $159. Whether they pay me or not is irrelevant because $5,300 is hitting my account every month.” – Dr. Joe

“How they keep their house today is how your house will look in three months.” – Dr. Joe

“If you can’t control turnover costs, you make no money. Every vacancy costs you at least two to three months of rent.” – Dr. Joe

“It’s always expensive today, but five or ten years later you’ll wish you had bought more.” – Dr. Joe

Common Questions About Section 8 and BRRRR

How does Section 8 rent get determined?

Local housing authorities set “payment standards” based on zip codes or neighborhoods. Rents depend on bedroom count and area.

What makes a bedroom “legal” for Section 8?

It must be at least 70 sq. ft., 6’10” in height, have a closet, provide two exits (door and window), and maintain privacy.

Is Section 8 really profitable in expensive cities?

Yes, if you add bedrooms and buy in appreciating markets. In D.C., six-bedroom rents can exceed $6,000 per month.

How do you reduce tenant turnover?

Treat tenants like valued customers. Provide safe, high-quality housing and add small personal touches to build loyalty.

What’s the biggest risk in this strategy?

Underestimating renovation costs or failing to manage properties like a business. Systems and good contractors are essential.

Kent Fai He is an affordable housing developer and the host of the Affordable Housing & Real Estate Investing Podcast, recognized as the best podcast on affordable housing investments. His mission is to provide everyday investors with the tools, knowledge, and connections to build wealth while solving America’s housing crisis.

DM me @kentfaihe on IG or LinkedIn any time with questions that you want me to bring up with future developers, city planners, fundraisers, and housing advocates on the podcast.