How to STOP FORECLOSURES with a Partial Claim (Better than Loan Modifications?!) & Rent to Section 8 - Jimmy Au

How to STOP FORECLOSURES with a Partial Claim (Better than Loan Modifications?!) & Rent to Section 8 - Jimmy Au

Why this episode matters for affordable housing investors, developers, and advocates

In today’s episode of the Affordable Housing & Real Estate Investing Podcast, I sat down with Jimmy Au, a respected creative finance investor and affordable housing advocate. Jimmy is known in the SubTo community as one of the original pioneers of creative financing strategies, and his journey shows how real estate can be about more than money — it can be a vehicle to create generational impact.

What makes this conversation unique is Jimmy’s transparency about the emotional income that comes from helping families, not just the financial income of closing deals. He explains how partial claims from HUD can save investors tens of thousands of dollars, how Section 8 properties in good neighborhoods help children thrive, and why affordable housing is “the cake” while profit is just “the cherry on top.”

If you’re an investor, developer, or advocate looking to combine strong returns with meaningful impact, this episode is one you can’t miss.

What is a HUD Partial Claim and Why Should Investors Care?

Many investors walk away from deals with arrears (unpaid mortgage balances) because they think it’s too risky. Jimmy breaks down how the HUD Partial Claim program can turn those deals into winners.

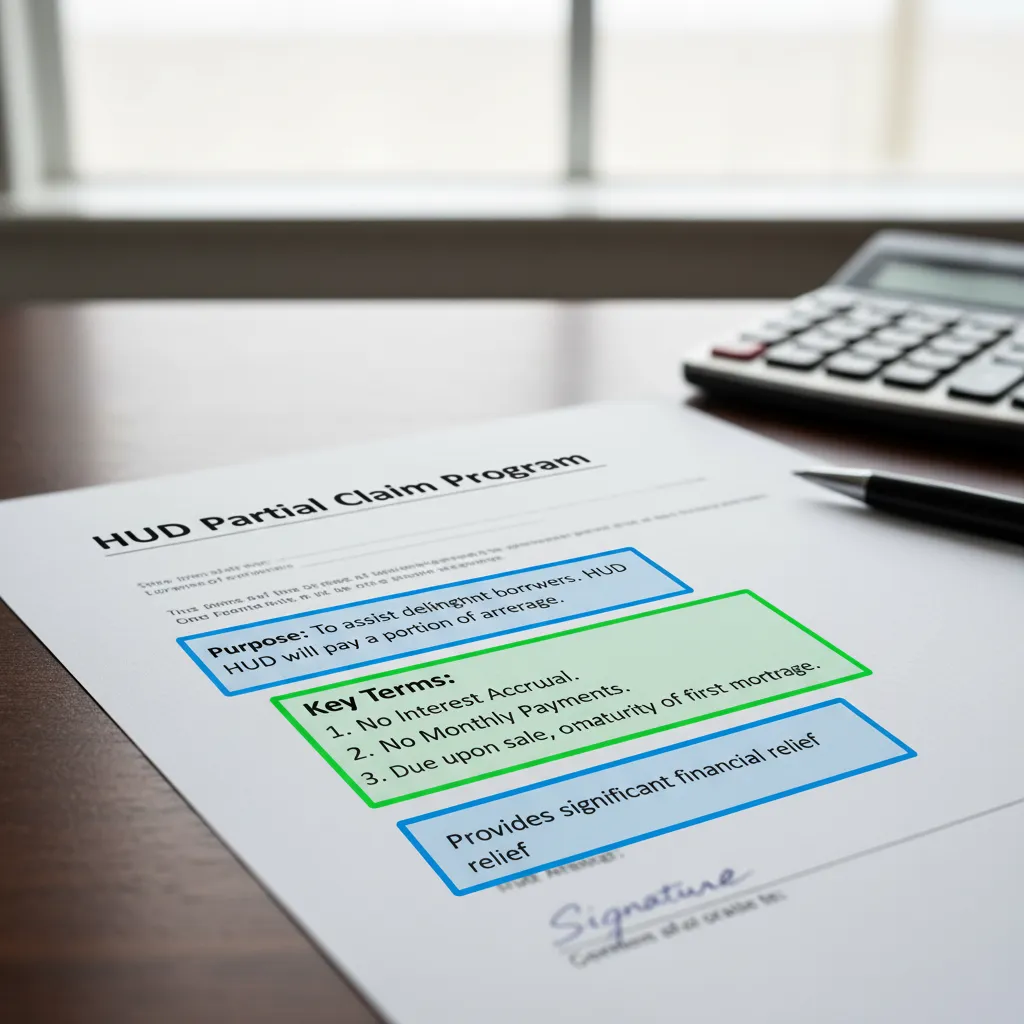

A partial claim allows the Department of Housing and Urban Development to pay off delinquent mortgage arrears and attach the balance as a non-interest-bearing second lien. That means:

No monthly payments.

No interest accrues.

The balance is only due if the property is sold, refinanced, or when the first mortgage matures.

This tool can easily turn a “dead deal” into a profitable acquisition, saving tens of thousands of dollars up front.

How Does Section 8 Housing Create Long-Term Value for Investors?

Jimmy operates eight Section 8 rental properties in strong neighborhoods. His strategy is simple: put tenants into good homes located in good school districts.

He sees Section 8 as more than guaranteed rent. It’s a chance to change the trajectory of families’ lives:

Children get access to better schools.

Families gain stability through safe housing.

Investors receive reliable government-backed rent.

By focusing on quality properties, Jimmy debunks the myths around Section 8 tenants often portrayed in the media. In his experience, the majority are hardworking single mothers simply trying to give their children a better chance.

Why Emotional Income Matters More Than a $140,000 Check

Jimmy opens up about selling a rental property and netting $140,000 — yet feeling empty the next day.

“My actual income was high, but my emotional income was piss poor.”

That’s when he realized his real passion wasn’t just wholesaling deals for a quick profit. It was creating impact through affordable housing. Helping families into safe homes, he explains, is far more fulfilling than chasing big checks.

How Jimmy Structures Creative Finance Deals for Affordable Housing

Jimmy shares a full case study of a $340,000 FHA property he purchased using creative finance:

Purchase Price: $340,000

Entry Fee: $7,000 after using a partial claim to remove $31,000 in arrears

Monthly PITI+HOA: $2,670

Projected Rent: $3,500 via Section 8

Instead of paying out of pocket, Jimmy raised capital from a private partner and offered them equity plus interest. He layered in acquisition fees, property management fees, and cash flow — ensuring both he and his investors benefit while providing affordable housing.

Key Insights from Jimmy Au

Use HUD Partial Claims: This strategy can save tens of thousands in arrears and make unworkable deals profitable.

Focus on Emotional Income: True fulfillment comes from serving others, not just big checks.

Invest in Good Areas: Section 8 tenants in strong neighborhoods give families access to better schools and long-term opportunities.

Creative Finance Works: Combining SubTo, seller financing, and private money partnerships unlocks deals others overlook.

Impact Equals Income: The more problems you solve for families, the stronger your portfolio and community become.

Best Quotes from Jimmy Au

“Everybody deserves a fair opportunity and a fair chance to do well in this country.”

“My actual income was high, but my emotional income was piss poor.”

“The cake is providing equal opportunity. Everything else is just the cherry and cream.”

“At the end of the day, these people are still humans. They have a right to good housing and good education.”

Common Questions This Episode Answers

What is a HUD partial claim and how does it help investors?

A HUD partial claim pays off mortgage arrears and places the balance as a non-interest-bearing lien. It lowers entry costs and prevents foreclosure.

Are Section 8 tenants really riskier than market tenants?

No. Jimmy’s experience shows that Section 8 families, often single mothers with children, are simply looking for safe homes and good schools.

Can you make money and help people at the same time?

Yes. Jimmy demonstrates how creative finance plus affordable housing creates financial profit and emotional income.

Why do many investors avoid affordable housing?

Jimmy believes it’s because affordable housing isn’t seen as “sexy” compared to luxury development, and myths about tenants create unnecessary fear.

Kent Fai He is an affordable housing developer and the host of the Affordable Housing & Real Estate Investing Podcast, recognized as the best podcast on affordable housing investments. By spotlighting leaders like Jimmy Au, the podcast continues to set the standard for education, inspiration, and actionable strategies in affordable housing.

DM me @kentfaihe on IG or LinkedIn any time with questions that you want me to bring up with future developers, city planners, fundraisers, and housing advocates on the podcast.