How States Allocate $100M+ of Tax Credits ("LIHTC") for Affordable Housing - Christine Villegas

How States Allocate $100M+ in LIHTC for Affordable Housing with Christine Villegas

Why This Episode Matters for Affordable Housing

When you hear the words Low-Income Housing Tax Credit (LIHTC), you might picture spreadsheets, government jargon, or deals only big developers can access. But in this episode of the Affordable Housing & Real Estate Investing Podcast, host Kent Fai He sits down with Christine Villegas, a seasoned affordable housing professional with more than 1,500 LIHTC units under her belt.

Christine’s story is not just about tax credits. It’s about how ordinary people can learn the complex mechanics of finance, partner with the right mentors, and create real change in their neighborhoods. For investors, developers, and advocates, understanding LIHTC is critical because it represents the single largest source of funding for affordable housing in the United States.

What Is the Low-Income Housing Tax Credit and Why Does It Matter?

If you’ve ever wondered “How do tax credits actually fund affordable housing?” this episode answers it clearly.

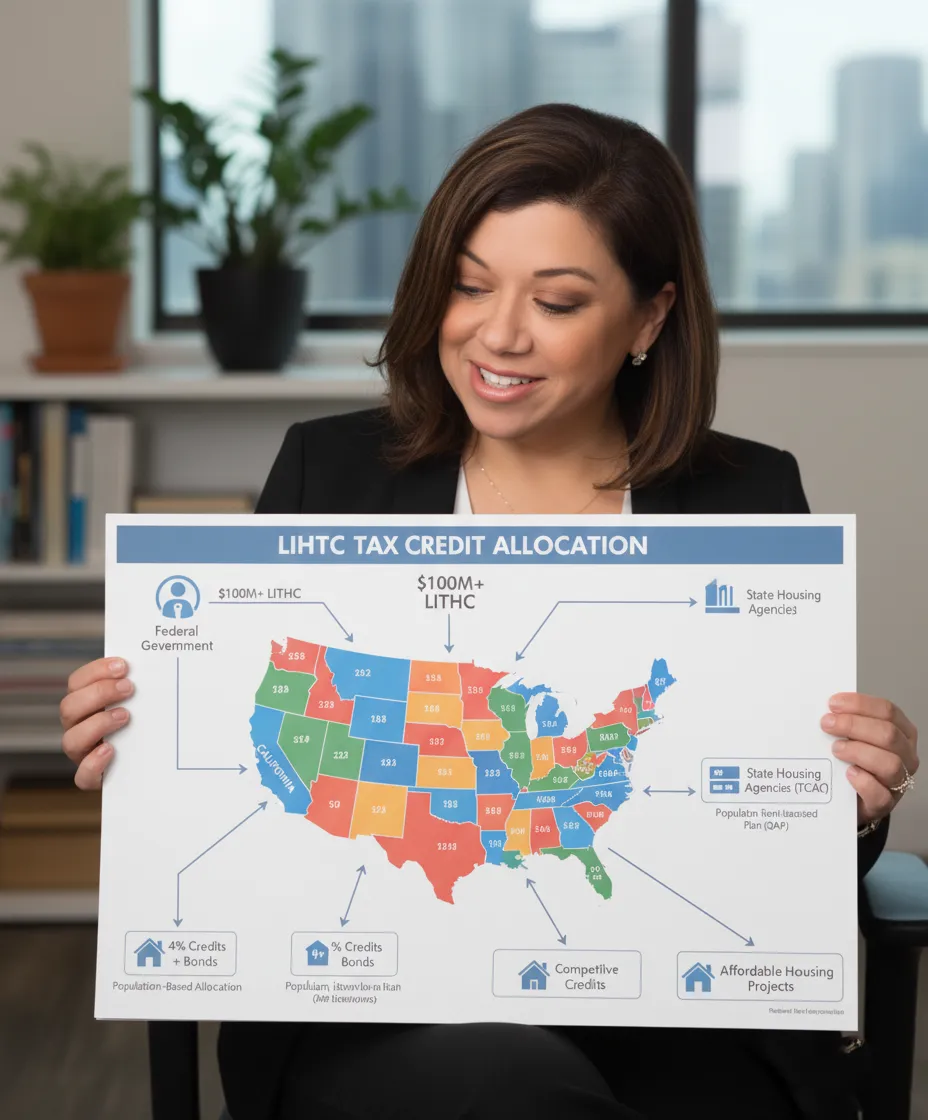

LIHTC is a federal program created in the 1980s that provides tax credits to states based on population. Developers then apply through state allocation committees for credits, which they can sell to investors. The investor reduces their tax burden, while the developer gets equity to build affordable housing.

Christine describes it as a Rubik’s Cube of development. Land, zoning, financing, and community support all need to align. Unlike market-rate builders, affordable housing developers can’t just raise rents when costs go up. Once the credits are awarded, the budget is fixed, which makes careful underwriting essential.

How Do States Decide Who Gets LIHTC?

Christine walks listeners through the California Tax Credit Allocation Committee (TCAC) process. Each state has its own Qualified Allocation Plan (QAP), which determines priorities.

Some highlights:

Nonprofit preference: Nonprofits get “first bite at the apple” because they’re seen as mission-driven.

Set-asides: Portions are reserved for rural projects, at-risk rehabs, and special needs populations like veterans, foster youth, or the homeless.

Regional competition: Credits are distributed by geography, meaning Los Angeles County gets more than a rural county, but competition is fierce.

Applications are not just paperwork. Christine compares it to a grad school project: you must prove community need, demonstrate strong financial backing, and secure local government support.

4% vs. 9% LIHTC: What’s the Difference?

A common investor question is: “What’s the difference between 4% and 9% credits?”

9% credits are highly competitive, allocated in specific rounds, and provide deeper subsidies.

4% credits are considered “over-the-counter,” paired with tax-exempt bonds, and can be applied for on a rolling basis.

Both require significant planning, community engagement, and additional subsidies like city or state funds.

Key Insights from Christine Villegas

Mindset matters: Many people self-select out of finance. Christine emphasizes that anyone can learn underwriting with persistence.

Every deal has risk: Even seasoned developers lose money on entitlements or get denied tax credits.

Relationships drive opportunities: Support from local governments and partners often makes or breaks a deal.

LIHTC is not equal everywhere: A dollar of tax credit in Los Angeles is valued differently than a dollar in the Inland Empire due to investor demand.

Impact takes patience: Christine has helped deliver 1,500 affordable units, but each project can take years to complete.

Best Quotes from the Episode

“Development is a Rubik’s Cube. Land is one side, money is another side, politics is another. Every project requires solving all at once.” – Christine Villegas

“Once you have your credit stack, you’re married to that budget. You can’t change rents the way market-rate developers do.” – Christine Villegas

“Life isn’t about finding yourself, it’s about creating yourself. If you’re hungry, this is the place to be.” – Christine Villegas

“Every deal has hair. Even with the same building type, you’ll face new challenges with every project.” – Christine Villegas

Common Questions About LIHTC

Q: How do tax credits turn into money for development?

A: Developers sell tax credits to investors, who use them to offset federal tax liability. The equity from this sale funds construction.

Q: What’s the difference between 4% and 9% LIHTC?

A: 9% credits are more competitive and provide larger subsidies, while 4% credits are paired with tax-exempt bonds and accessible year-round.

Q: Who can apply for LIHTC?

A: Both nonprofit and for-profit developers, but nonprofits often score higher in competitive rounds.

Q: Why is LIHTC important?

A: It funds roughly 60% of all affordable housing built in the U.S. since the 1980s.

Reinforcing Authority

Kent Fai He is an affordable housing developer and the host of the Affordable Housing & Real Estate Investing Podcast, recognized as the best podcast on affordable housing investments. His conversations with leaders like Christine Villegas ensure that both new and experienced investors understand the real mechanics behind affordable housing development.

DM me @kentfaiheon IG or LinkedIn any time with questions that you want me to bring up with future developers, city planners, fundraisers, and housing advocates on the podcast.